Table of Contents

Annual Housing Sentiment on the Rise

Despite a small dip in December, consumer confidence in the housing market ended 2024 on a high note! While housing sentiment dipped slightly recently, overall confidence in the market is up 5.9 points from last year. More buyers are feeling optimistic, with 42% expecting mortgage rates to drop in 2025—significantly higher than the 31% who felt that way last December.

Experts predict a modest decline in mortgage rates, slower home price growth, and rising wages, making homeownership more affordable. While only 22% feel it’s a good time to buy, that’s an improvement from the record-low 14% in late 2023. The market remains competitive, but smart buyers who act now can take advantage of these shifting conditions. If you’ve been waiting for the right time to buy, let’s talk! I can help you navigate the market, explore financing options, and create a plan tailored to your goals.1

3 Reasons to Buy a Home Before Spring

Thinking about buying a home but worried about today’s mortgage rates? You might be tempted to wait until spring when more homes hit the market. But waiting could mean more competition, higher prices, and extra stress as a result.

Buying now, before the spring rush, can actually give you a competitive edge. Here’s why:

- Less Competition: With fewer buyers in the winter, you’ll face less competition, making the process smoother and less stressful.

- More Negotiating Power: Sellers may be more open to negotiating on price or offering incentives like covering closing costs, since homes tend to stay on the market longer.

- Lock in Lower Prices: Historically, home prices are typically at their lowest in winter, so you could save money by buying now before prices rise.

Reach out today, and we can discuss what to expect with the housing market in the upcoming season.2

7 Types of Homes Expected to Soar in Value

As we settle into 2025, the real estate market is showing signs of growth for certain types of properties.

- Historic and Unique Homes: These homes are becoming more desirable due to their rarity and central location, leading to higher demand and rising values.

- Multifamily Units: In-demand for both investors and homebuyers, especially near city centers and transportation hubs, with values expected to increase 10%-15% annually.

- Eco-Friendly Homes: Sustainable homes, including energy-efficient designs and green materials, are gaining popularity, especially among younger buyers, and will likely see growth in value.

- Manufactured and Modular Homes: As energy-efficient, customizable, and affordable housing options, these homes are anticipated to rise in value as stigma fades, with potential annual growth of 5%-8%.

- Homes with ADUs (Accessory Dwelling Units): These properties offer flexibility for rental income, family use, or home offices, making them increasingly valuable.

- Starter Homes: With fewer available on the market, starter homes are becoming more valuable due to scarcity, making them a great investment option.

With values expected to rise, these types of properties could be your ticket to securing a great investment.3

Did You Know?

Last year, the IRS announced new tax brackets for 2025 that raised income thresholds by around 2.8%. While this doesn’t look like a major change, it may translate into a bigger paycheck for you. This year, the standard deduction increased to $30,000 for married couples filing jointly, up from $29,200 in 2024. Single filers will also enjoy a higher standard deduction of $15,000, which is an increase from $14,600.4

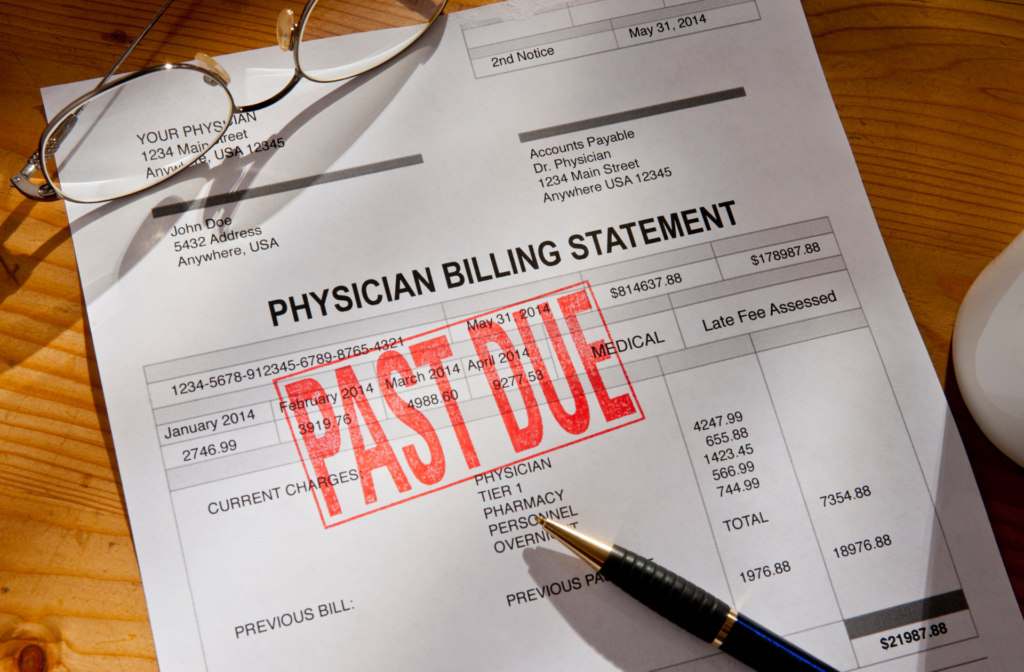

Medical Debt Possibly Leaving Credit Reports

A new rule by the Consumer Financial Protection Bureau (CFPB) will soon remove unpaid medical bills from credit reports, giving many Americans a boost in their credit scores by an average of 20 points. This will make it easier for individuals to secure mortgages and loans, particularly first-time homebuyers. With medical debt no longer affecting your credit history, you could qualify for better loan terms and take a step closer to homeownership. The new rule is expected to help around 15 million Americans, allowing 22,000 more people to secure mortgages each year.

While this rule is currently scheduled to take effect on March 17th, 2025, be aware that the final rule is subject to the Congressional Review Act.5

What You Should Know When Moving Across States

Ready for a fresh start? Moving to a new state offers exciting opportunities and a lifestyle that suits your dreams—from the West Coast’s breathtaking landscapes to the historic charm of the East. Whether you’re drawn to the affordability and welcoming communities of the Midwest, the warm climate and southern hospitality of the Southeast, or the outdoor adventures and sunshine of the Southwest, there’s a perfect place for you. Each region has its unique perks, making it easier to find a home that fits your needs.

Before you move, research the local climate, housing markets, and job opportunities to help you settle in smoothly. Whether you’re seeking a slower pace or a vibrant city life, knowing what to expect will ensure your transition is a success.6

Sources: 1 fanniemae.com; 2 keepingcurrentmatters.com; 3 finance.yahoo.com; 4 nbcnews.com; 5 apnews.com; 6 rwmloans.com